The Advance Q4 GDP report showed that real GDP rose 3.3%, well above the consensus estimate of 2.0% (last 5.2%; revised down to 4.9%) and even above the highest Wall Street estimate of +2.5%. That’s a 5 sigma beat of consensus and makes you wonder how everyone on Wall Street got GDP so wrong? Or if the BEA was “cooking the books?”

A few things stood out, but one made my jaw drop.

According to the BEA,

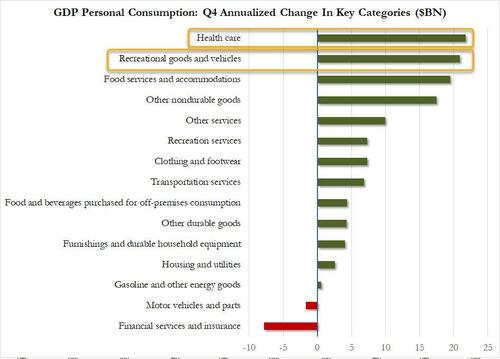

“The increase in consumer spending reflected increases in both services and goods. Within services, the leading contributors were food services and accommodations as well as health care. Within goods, the leading contributors to the increase were other nondurable goods (led by pharmaceutical products) as well as recreational goods and vehicles.”

Also according to the BEA (because while this print beat expectations, it was well below last quarter’s government spending frenzy),

The “deceleration in GDP in the fourth quarter primarily reflected slowdowns in inventory investment, federal government spending, housing investment, and consumer spending. Imports decelerated.”

Looking under the hood, nearly half of the increase in consumer spending can be attributed to Healthcare and R.V.’s . Yes, recreational vehicles.

If you’ve been around the market for a decade or so, you might recall that R.V.’s was a regular contributor to stronger than expected GDP beats during the Obama administration. We’ve seen economic data showing Americans are using credit cards to make ends meet, so the RV sales component stood out as strange to me, yet familiar.

Before we move on, let’s take a look at how we arrive at Real GDP. Here’s the formula:

- GDP= Consumption + Investment + Government Spending + Net of exports/imports (imports are a subtraction from GDP).

It’s worth noting that,

- The U.S. Federal government spending (including proxy wars like Ukraine) has recently equaled about 1/3 of the GDP number.

- The Federal Government is running a $1.7 trillion deficit

- The Federal Government is nearing $35 trillion in debt, so that government “spending” is borrowing from future generations to spend today, and throw it into the category of “economic growth” in GDP. It’s kind of screwy, but it is spending so we won’t focus on that.

What hit me immediately was the “deflator” component of GDP print this morning. I’m not sure where it came from at 1.5%. The deflator is the proxy for inflation. The consensus expectation for the deflator was 2.8%, which sounds reasonable to me considering the most recent inflation data has been running around 3%. The Advance Q4 GDP’s deflator was just 1.5%, almost half of consensus expectations of 2.8%. Hmm.

The most recent CPI (inflation) from December was 3.4% according to… the government run BLS (Bureau of Labor Statistics). The last (Q3) GDP deflator was 3.3%. If you believe the inflation rate is 1.5% as the Advance Q4 GDP figures, then the GDP growth number of 3.3% is legit, but if you use the government’s own, most recently released inflation of 3.4%, then GDP is overstated by 190 basis points and growth is more like 1.4%, not 3.3%! That’s a big difference.

It’s a screwy report.