From what I’ve been reading, it sounds like Israel’s IDF is prepared to go into Gaza/Gaza city over the weekend. In the early morning hours Israel dropped tens of thousands of flyers from the air urging Gaza city residents to evacuate to the south. The IDF believes that Hamas are holed up in tunnels below houses and buildings in Gaza city, so it appears this weekend is about to see a major escalation in Gaza, whether that be from the air, or boots on the ground.

Of course with that comes the risk of a full fledged war on Israel’s’ northern border with Lebanon against the much better outfitted and trained, Iranian-backed Hezbollah.

Remember that the market maxim that proved true last year as Russia invaded Ukraine, “When the missiles fly it’s time to buy”, isn’t about war or the war machine, it’s about the fact that the market HATES uncertainty, such as the build up to war. Once war starts, that uncertainty is removed and that’s what the phrase is really addressing.

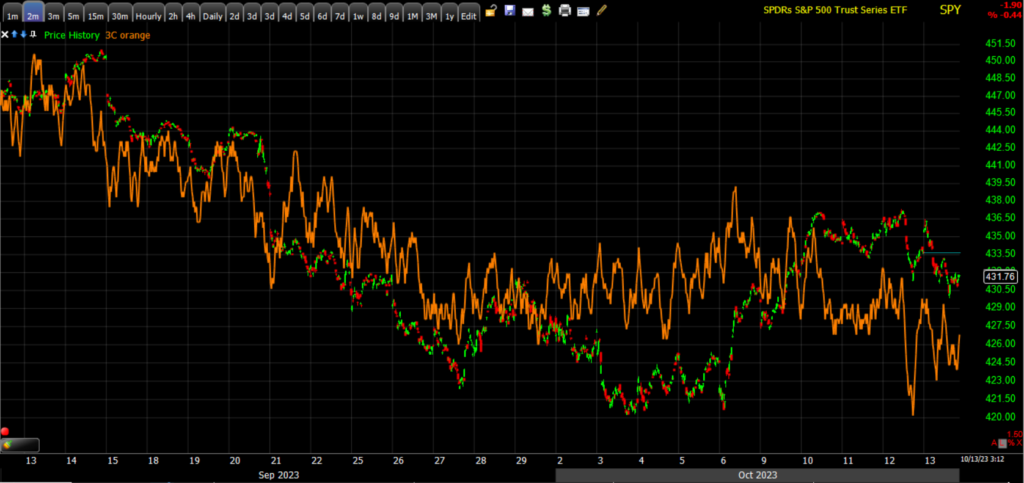

The equity market today has been relatively calm – the S&P is down less than a half percent and in the throes of some sort of consolidation, although it’s not exactly clear what yet…

SP-500 (10m) it sort of looks like a sloppy, volatile bull flag, but perhaps it will just be a pull back and not a consolidation.

SP-500 (10m) it sort of looks like a sloppy, volatile bull flag, but perhaps it will just be a pull back and not a consolidation.

3C hasn’t gotten any worse than it was at yesterday’s worst point…

SPY (1m), but it does suggest we have some more downside correcting to do.

SPY (1m), but it does suggest we have some more downside correcting to do.

The NASDAQ-100 is down closer to -1% with the mega-caps underperforming today after 2 days of relative strength, and 2 days before that of relative weakness – or at least not in favor among investors at the start of the week.

NASDAQ-100 (15m) this poorly confirmed inverse H&S base had a measured move of $15,385, the NDX came within a third of a percent, or made it 90% of the way to the target level. The most probable thing to happen after a measured move is a consolidation or correction. Price appears to be correcting in this case as investor conviction on the long side remains extremely low compared to the rest of the year.

NASDAQ-100 (15m) this poorly confirmed inverse H&S base had a measured move of $15,385, the NDX came within a third of a percent, or made it 90% of the way to the target level. The most probable thing to happen after a measured move is a consolidation or correction. Price appears to be correcting in this case as investor conviction on the long side remains extremely low compared to the rest of the year.

The Dow, which just so happens to have the most constructive 3C chart the past week, is up +0.1% and trading just below its neck line.

Dow (10m) – again a sloppy price range that’s not identifiable as a clear consolidation, but given low investor conviction, I wouldn’t expect it to trade north of the neckline without a catalyst, regardless of the war.

Small Caps are a mess, but they’ve been a mess long before this week as they’re the only average that almost completed the full downside measured move from their own H&S top. NASDAQ barely pushed below the H&S top’s neck line and S&P made it to the half way point before correcting as is common.

Where we’re seeing investor angst is in safe havens. Longer term Treasuries are bid with yields up 8 to 9 bp at the 10 and 30 year. Gold futures are up over 3% today as gold is a traditional safe haven. Compared to yields, gold should probably be trading around $1880, instead it’s at $1940 -that’s a flight to safety trade.

Gold futures (30m) vs. 10-year UST futures, and notice the heavy buy side volume today heading in to the weekend.

Gold futures (30m) vs. 10-year UST futures, and notice the heavy buy side volume today heading in to the weekend.

Another sign of investor concern over the weekend and what may happen in Gaza, is the risk premium assigned to oil today with WTI Crude futures up +5.6%. That’s war premium.

Furthermore, hedging is apparent as VIX (+14.8%) and VVIX (+18.1%) are performing well above their expected correlation considering the S&P down just half a percent. It’s quite clear…

SPX (1m) with price inverted for context and VIX (white) – notice the huge relative performance spike today?

On the day, HYG (-0.1%) is acting fairly normal, in part helped by lower yields, but it’s not ringing immediate alarm bells, but the issues pointed out in multiple timeframes in last night’s Daily Wrap are still there, but this isn’t about the weekend, this is about the economic cycle.

As far as the averages go relative to the decline in yields on the week (which were driven by flight to safety buys in Treasuries), the averages are about where I’d expect.

S&P futures (7m) and 10-year TSY futures.

S&P futures (7m) and 10-year TSY futures.

Where I do have more concern is the U.S. Dollar, which I think got a missive flight to safety bid yesterday – it was a flight to safety asset at the start of the week as well after last weekend’s events rocked Israel.

NASDAQ-100 futures (7m) and the Dollar Index (price inverted for context). This doesn’t help stocks by any means, but it does appear to be a kneejerk reaction (flight to safety) as well.

NASDAQ-100 futures (7m) and the Dollar Index (price inverted for context). This doesn’t help stocks by any means, but it does appear to be a kneejerk reaction (flight to safety) as well.

Heading in to the weekend, I see no advantage to being long the market. There simply are not the supportive edges that give you a high probability reason to be long. If the weekend passes somewhat uneventfully, then Volatility will be unwound and that may help stocks. Some flight to safety trades like the Dollar may be unwound and that would be helpful for stocks, but Treasuries bought as a safe haven being unwound, would not be helpful.

I think being long or significantly short heading in to the weekend, you’re pretty much placing a roulette bet, Black or Red on how things pan out in the middle east, and while I’d lean toward them being an escalation, that doesn’t necessarily mean that the feared consequences of an escalation materialize (like Hezbollah invading Israel from Lebanon.

Otherwise, if things come out relatively smooth with no major escalation in terms of geopolitics (Gaza city will be an escalation), then I think the stock market tries to refocus on earnings season. And like last earnings season it won’t be so much about what companies report for the last quarter, but what they report for guidance moving forward.

So far JPM (+1.5%), Wells Fargo (+2.85%), Citi (-0.3%) and Untied Health (+1.8%) reported and the results in price action have been overall pretty good, at least not too concerning, but the big banks, especially JPM, usually tend to report fairly well as earnings season kicks off.

As far as short trades, I’d like to give the market a bit more time to get through earnings season, as well as see what happens with longer term yields which as of now, are in a minor pull back despite yesterday’s surge on the CPI data.

10-year yield (15m) thus far in a very short term (this week) down trend with key trend lines coming in to play and the key 4,50% level just below. It is very ironic that the pull back and yields and subsequent bounce for most averages this week (SPX +0.5% Dow +0.7%, NASDAQ-100 +0.1%) Small Caps -1.6%) has been a result of what happened in Israel last weekend. It seems counterintuitive that stocks should gain (save for small caps, but that has more to do with Regional Banks -1.6%) on such a tragedy, but that just goes to show how important the correlation with yields still is.

10-year yield (15m) thus far in a very short term (this week) down trend with key trend lines coming in to play and the key 4,50% level just below. It is very ironic that the pull back and yields and subsequent bounce for most averages this week (SPX +0.5% Dow +0.7%, NASDAQ-100 +0.1%) Small Caps -1.6%) has been a result of what happened in Israel last weekend. It seems counterintuitive that stocks should gain (save for small caps, but that has more to do with Regional Banks -1.6%) on such a tragedy, but that just goes to show how important the correlation with yields still is.

I’ll have more out this weekend, but for now I’m in wait-and-see mode, looking for that high probability, low risk set up.