2:08 p.m. ET

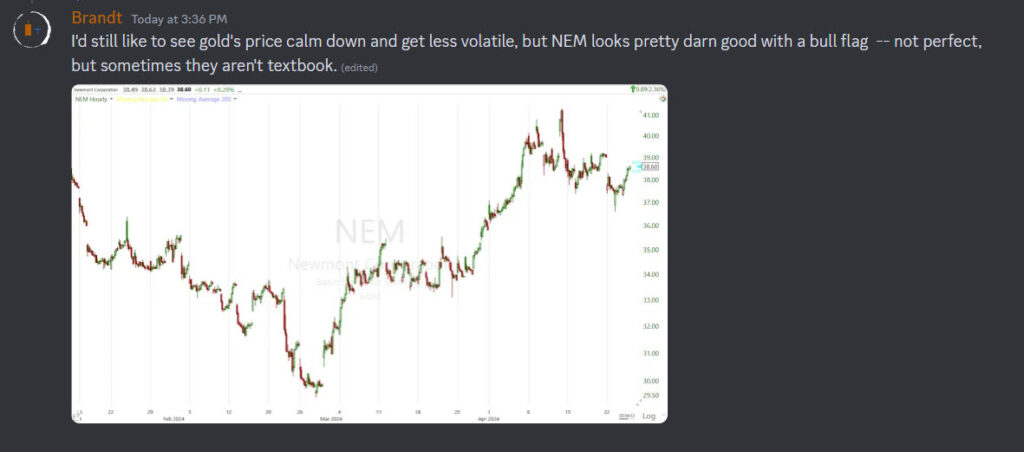

I featured NEM yesterday after it came up in The Technical Take Discord room.

Newmont was sitting in a nice bull flag ahead of earnings…

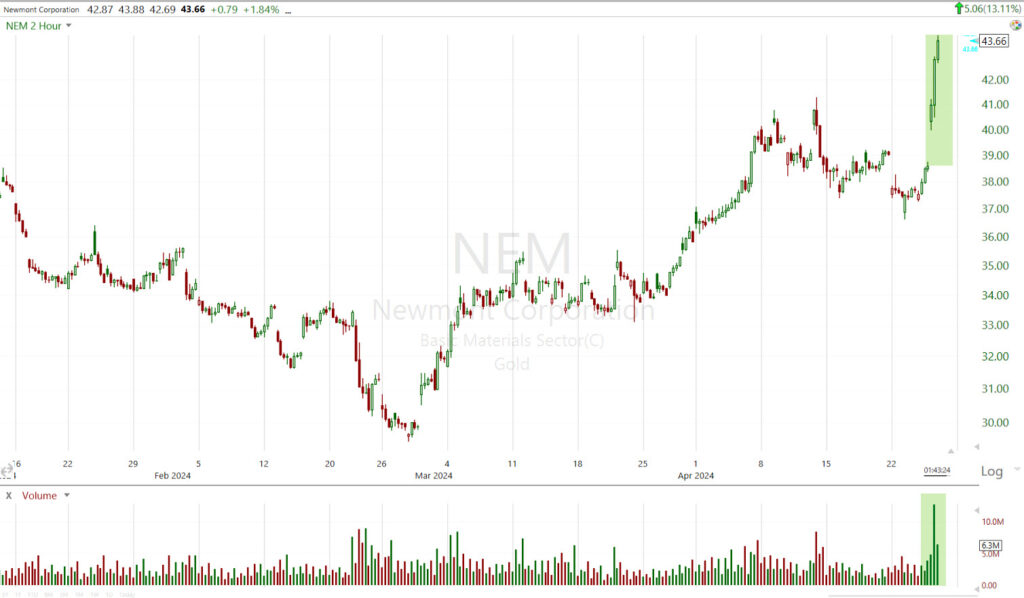

Today, a breakout and up +13.25%…

NEM (2H) – today shaded green, and look at the beautiful heavy buy-side volume on the breakout… TEXTBOOK.

NEM (2H) – today shaded green, and look at the beautiful heavy buy-side volume on the breakout… TEXTBOOK.

Now, the measured move for this leg…

(2H) The measured move is about 20%, which gives a price target of $46.50 (lets say $46 to $46.50). There’s reasonably good chance that somewhere here around the half-way point there’s a small mid-move bullish consolidation. That hasn’t taken shape yet, but if it does, current longs can consider adding to their position (add to trades that work, rather than averaging down in trades that aren’t working). Anyone interested in a new long position could use such a consolidation to establish a position. Another 10% or so at a mid-point consolidation isn’t shabby and risk/reward is excellent as risk is very low so long as any mid-point consolidation is a bullish one and I see no reason it wouldn’t be.

What happens after the measured move is met? The most probable outcome is another bullish consolidation, especially given the fact that the primary downtrend is broken and a new up-trend has begun.

NEM (daily) in a primary downtrend/channel. Notice the tell-tale sign of an impending trend change – a pick-up in selling or sellers’ capitulation that creates a bullish Channel Buster. If you don’t know or recall what my Channel Buster concept is, here’s a quick 90 second video.

NEM (daily) in a primary downtrend/channel. Notice the tell-tale sign of an impending trend change – a pick-up in selling or sellers’ capitulation that creates a bullish Channel Buster. If you don’t know or recall what my Channel Buster concept is, here’s a quick 90 second video.

More importantly, a new uptrend is underway so the probability that we get another bullish consolidation after the measured move is met, is quite high.

I know some of you are in NEM. Congratulations on a nice pick and a strong day that loos to have more to come. Put this one on your watchlist.