Test Post 3

Sorry for these, they need to be done…. Membership Required You must be a member to access this content.View Membership LevelsAlready a member? Log in here...

Test Post

Just a test post… Membership Required You must be a member to access this content.View Membership LevelsAlready a member? Log in here...

Test Post

Just a test post, checking email delivery…. Membership Required You must be a member to access this content.View Membership LevelsAlready a member? Log in here...

Early Update – $5040 Holding, But Not A Great Start

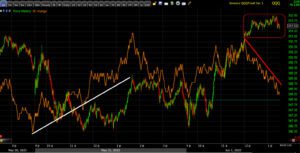

11:18 a.m. ET Not a great start – as soon as the cash market opened selling began. Semis are one of the groups being sold into the open, hitting NASDAQ harder, but it gives us a front row seat as to whether the S&P holds the $5040 area (the trend line I sketched in yesterday morning), while other averages are legging down (Transports). SP-500 -0.1%, Dow -0.15% (Transports -1.7%), NASDAQ-100…...

Daily Wrap – Mega Caps Stating To Falter

There was not a lot of conviction on either side of the tape today with the Fed tomorrow, plus we get other tier 1 economic data and the second half of the Treasury RFA, and some important earnings after the bell. While there wasn’t a lot of conviction, there were themes. Today’s wishy-washy trade was also consistent with yesterday’s 1-day overbought internals. Relative weakness in mega cap and semiconductor-related stocks…...

Stock Market & Economic Forecast 2024 (Video Update)

… Membership Required You must be a member to access this content.View Membership LevelsAlready a member? Log in here...

Extreme Sentiment Is Contrarian

Overnight one of the events of the week was the Bank of Japan’s policy meeting as some BOJ officials hinted the BOJ may raise rates and exit their long term policy of negative interest rates, which would almost certainly send global yields higher. As many of us long time BOJ watchers suspected, the Bank of Japan did nothing and held policy rates unchanged at -0.10%. The BOJ couldn’t pull the…...

Stock Market Video Update: Stock Market Forecast For Second Half Of 2023 Remains On Track

The stock market’s 8-plus month rally remains in effect as we move into the third quarter, and the second half of 2023. The NASDAQ-100 gained +15% in Q2 and is up 38.75% for the year! It has been the best first half for the Nasdaq Composite since 1983, which is remarkable given that it has occurred in the midst of an aggressive tightening cycle by the Federal Reserve, 14 consecutive…...

NASDAQ Distribution

1:47 p.m. ET The S&P trades back above $4200 and all of the averages trade near the best levels of the day, but are coming up on or are at recent highs which could prove to be local resistance. For example.. SP-500 (5m) just under Tuesday morning’s opening highs. NASDAQ-100 (5m) breaking out of a bull flag this morning, but also just under Tuesday’s opening highs where we did see…...

Stock Market Daily Wrap – May 18, 2023

This is a post from Wolf on Wall Street Trade, my current subscriber website. The Technical Take will be online to replace WOWS shortly. This is the Daily Wrap for Thursday, May 18th, 2023. Today the stock market built on yesterday’s gains, which saw the S&P-500 trade up to the 7-week lateral range upper trend line, then consolidate bullishly the last 2 hours of the day just below. The S&P-500…...

Daily Wrap

Daily Wrap test… Membership Required You must be a member to access this content.View Membership LevelsAlready a member? Log in here...

Early Update

12:03 p.m. ET There are quite a few interesting developments this morning, and it’s been a fast moving market with a bullish shift into the cash open, thus it’s taken longer than I’d like to get this post out reflecting the most recent data. Briefly recapping, the first half of last week was dominated by reactions to UK fiscal and monetary policy conflicts, sending Cable and GILTs lower as well…...