*The nightly Subscribers’ Daily Wrap post from Wolf-on-WallStreet-Trade.com

We know that with the light macroeconomic week, Nvidia is the week’s fulcrum event. What we didn’t know (although perhaps suspected if you caught the weekend news) was the probability of geopolitical tensions flaring up in a big way.

On that front, after Ukraine launched 6 U.S. longer range missiles into Russia yesterday, they launched another 12 U.K Storm Shadow cruise missiles into Russia overnight. In war, with a country that has been invaded by another, this kind of thing wouldn’t normally raise eyebrows, and I’m not criticizing Ukraine’s right to do so. I do question the timing of the escalation considering these weapons have been banned for use inside Russia by the U.S. and NATO the entirety of the war, until this weekend. The fact that nukes are on the table with their use, just raises the risks.

Before the U.S. authorization this weekend, Russia updated its nuclear doctrine and signed it into law, which considers any such attacks as reason enough to use nukes. Furthermore, Russia had warned the Biden administration for months that if such missiles are launched into Russia, that could/would be viewed as a major escalation that “could” be characterized as Russia at war with the U.S., and now with the U.K joining in, with NATO.

I don’t know the reason for their sudden White House approval this weekend — which proceeded the Pentagon lifting a ban on U.S. military contractors (mercenaries) to join the war effort in Ukraine — and I’m not going to assume I do. What I do know, which is the only relevant factor for our purposes, is the market hates uncertainty and this is a certainly a new element of uncertainty, as are expanding Israeli strikes in areas like Beirut and Syria. That’s to say nothing of the brewing China/Taiwan showdown that’s not covered much by the media.

The reaction was similar to yesterday, just not as intense, especially on the safe-haven trades being bid.

After the initial knee jerk lower, the market went right back to focusing on Nvidia earnings, and went right back into Bear Flag consolidations, albeit wider than Monday, which is normal.

I didn’t get any intraday data for the Dow today. I see it wasn’t limited to my charting platforms.

Some buyers appeared into the close ahead of NVDA’s earnings. There seemed to be an Nvidia beat move (modest), and also a cyclical option to get back to the Trump trade in case Nvidia didn’t spark a resurgence in Growth/Momentum/Large-Cap Tech. This trade was much more modest too, pretty much confined to the Financial sector, while Health Care continues to look horrible since the election.

Economic Data – another light day…

- Weekly MBA Mortgage Applications Index, which increased 1.7% with purchase applications increasing 2% and refinance applications rising 2%

- Weekly EIA crude oil inventories showed a build of 545,000 barrels, ore than expected.

On the central bank side of things, Fed Governor Michelle Bowman hit the market with some hawk-talk.

“We have seen considerable progress in lowering inflation since early 2023, but progress seems to have stalled in recent months,”

“I would prefer to proceed cautiously in bringing the policy rate down to better assess how far we are from the end point,”

Rate cut odds for 25 basis points in December fell from 82.5% a week ago to 53.9% which is approaching the go/no-go level of 50% for the Fed. Add to that Powell’s hawkish comments last Thursday, my bet is the Fed will hold in December. This may create favorable conditions, depending on what’s said, for a longer-term Eurodollar trade (not the FX pair, the rates trade). History has shown that the Fed cuts by 550 basis points on average in a rate cutting cycle. That would bring the Fed Funds rate back to zero-percent. We’ll cross that bridge when we get there, but it may be as soon as December.

Averages

The stock market had a mixed showing. The major indices ultimately settled near their best levels of the session thanks to a late afternoon push higher. Dow Transports were unchanged (0%), remaining right at the 2021 record high test.

S&P-500 0.00 %

NASDAQ ⇩ -0.08 %

DOW JONES ⇧ 0.32 %

RUSSELL 2000 ⇧ 0.03 %

For some context, here’s the SPX’s daily chart.

If the current bear flag fails, it’s a -1.65% measured move lower for the SPX, which may just turn into a likely successful test of the 50-day sma (yellow).

If the current bear flag fails, it’s a -1.65% measured move lower for the SPX, which may just turn into a likely successful test of the 50-day sma (yellow).

The NDX is nearly identical on a daily chart.

VIX gained +6.1% in a showing of the expected relative strength to develop today ahead of Nvidia’s earnings. VVIX (+6.8%) is well bid too. Absolute performance recently favors VIX, but relative performance between the two are nearly in lock-sync. VVIX tends to lead VIX, but we’re in a blank spot of no notable near-term (post-election) relative performance trends.

The Absolute Breadth Index dropped about 2 points to 27 today.

S&P sectors

Sectors were mixed just like yesterday with 6 up and 5 down (typical of a consolidation).

Strong: Health Care, Energy, Materials and Communications.

Weak: Consumer Staples and Consumer Discretionary. The former was weaker on Target’s earnings, and while not part of the latter sector, Target does have a high degree of Discretionary products as opposed to Walmart that leans far more toward Staples. Mega Caps, Tesla (TSLA -1.15%) and Amazon (AMZN -0.85%), weighed on the Discretionary sector.

The Retail sector (-0.9%) was noticeably weak after Target’s (TGT -22%) disappointing guidance.

The mega cap growth index (-0.15%) trailed the Equal Weight S&P (+0.3%) by 45bp , but more importantly is the same bear flag as the major averages…

MGK (10m) The measured move isn’t huge (-2.5%), but does speak to market tone since the election rally lost steam and into Nvidia’s earnings.

Semiconductors (SOX -0.7%) were relatively weak, down as much as -2.15% today, but the late day bid mitigated much of the earlier losses.

(10m) – This is not a good looking chart. Nvidia is still down in afterhours, but tomorrow’s cash session should give us a more definitive feel for the SOX Index, which is less than -1.5% from a definitive pivot lower from the right shoulder of a large H&S top.

(10m) – This is not a good looking chart. Nvidia is still down in afterhours, but tomorrow’s cash session should give us a more definitive feel for the SOX Index, which is less than -1.5% from a definitive pivot lower from the right shoulder of a large H&S top.

Speaking of H&S tops, Microsoft (MSFT -0.6%) is looking toppy, too.

(daily) – Hopefully you can see the red trend line. The 50-day is just a hair away from a Death Cross below the 200-day SMA.

(daily) – Hopefully you can see the red trend line. The 50-day is just a hair away from a Death Cross below the 200-day SMA.

Taking a closer look at price/volume action…

(daily) – The price/volume action isn’t the worst I’ve seen. The green arrow shows advancing price and volume, that’s healthy, but fading volume on an advance into the high (yellow arrow) and an increase in volume on the decline from the high (red) is exactly what we see at H&S tops.

(daily) – The price/volume action isn’t the worst I’ve seen. The green arrow shows advancing price and volume, that’s healthy, but fading volume on an advance into the high (yellow arrow) and an increase in volume on the decline from the high (red) is exactly what we see at H&S tops.

Furthermore…

(daily) – You can see the dates at the top of the chart. MSFT’s relative performance vs. the Nasdaq-100 has begun to very clearly dump. While there’s much more to this change than this (such as Azure’s weaker performance than expected), I imagine the Trump administration going after Alphabet, Meta, Microsoft and Apple over censorship, won’t be helpful. Trump’s pick for FCC-chair has already said as much. It’s looking like an uphill climb at best, and a toppy pattern at worst.

(daily) – You can see the dates at the top of the chart. MSFT’s relative performance vs. the Nasdaq-100 has begun to very clearly dump. While there’s much more to this change than this (such as Azure’s weaker performance than expected), I imagine the Trump administration going after Alphabet, Meta, Microsoft and Apple over censorship, won’t be helpful. Trump’s pick for FCC-chair has already said as much. It’s looking like an uphill climb at best, and a toppy pattern at worst.

Materials ⇧ 0.82 %

Energy ⇧ 1.01 %

Financials ⇩ -0.30 %

Industrial ⇧ 0.11 %

Technology ⇩ -0.09 %

Consumer Staples ⇩ -0.51 %

Utilities ⇧ 0.05 %

Health Care ⇧ 1.18 %

Consumer Discretionary ⇩ -0.44 %

Real Estate ⇩ -0.16 %

Communications ⇧ 0.64 %

Target (TGT) “soiled the bed” with this morning’s earnings, losing -22%. Target’s earnings missed on Comparable Sales +0.3% ( vs consensus +1.5%) and EPS ($1.85 vs consensus $2.30). Walmart’s (WMT +0.65%) earnings were stellar. Walmart reported reported earnings that beat across the board for the third quarter, but also raised its guidance for the third time in a row. There were also signs that wealthier customers traded down to the big box retailer, driving ticket sizes higher. That growth was driven by upper-income households making $100,000 a year or more. Amid record credit card debt and personal savings plunging to all-time lows, both wealthy and low-income households are looking for the best deals from big-box retailers.

Walmart vs. Target (daily and normalized YTD) – Walmart is acting just like it always does late in an economic cycle with a strong trend and relative performance. When a recession actually comes, WMT tends to lose ground as earnings growth fades due to consumers tightening their belts. Remember that Target also has a higher percentage (60%) of consumer discretionary items as opposed to Walmart’s heavier Consumer Staples-related grocery and household items.

Walmart vs. Target (daily and normalized YTD) – Walmart is acting just like it always does late in an economic cycle with a strong trend and relative performance. When a recession actually comes, WMT tends to lose ground as earnings growth fades due to consumers tightening their belts. Remember that Target also has a higher percentage (60%) of consumer discretionary items as opposed to Walmart’s heavier Consumer Staples-related grocery and household items.

Internals

NYSE Decliners (1463) and Advancers (1253) were similar again, which is typical of a consolidation. Volume was notably lower at 891 mln. shares, also typical of a consolidation as it matures.

The Dominant price/volume relationship wouldn’t matter as there’s 2 of the other 3 factors for 1-day internal signals weren’t even close. There was no truly dominant theme, but both SPX and NDX’s highest relationship was the most bearish of the four relationships at Close Up/Volume Down.

The Nasdaq composite’s A/D line hasn’t made any progress this week, which isn’t a great sign for the cyclical/value/small caps trade.

Nor has the NYSE’s A/D line.

The percentage of NYSE stocks above their 40-day SMA remains below 50% (49%).

Treasuries

Treasury yields initially moved lower on a modest flight to safety trade in response to geopolitical angst. Today was not as strong of a flight to safety trade as yesterday’s first salvo of missiles fired. Treasury yields ended the day higher, sparked by Fed Governor Bowman’s (FOMC voter) hawkish-leaning comments, and after today’s $16 billion 20-yr bond auction met weak demand. The 2-yr yield settled three basis points higher at 4.30%. The 10-yr yield settled four basis points higher at 4.41%.

Currencies and Commodities

The U.S. Dollar Index gained +0.45% to $106.63, and nearing a breakout from its recent small bullish flag consolidation.

(60m) – Not quite at a breakout, but close. This is also the most important and potentially dangerous time of a breakout. A higher Dollar should continue to lend support to Bitcoin in the current strong-Dollar policy environment.

(60m) – Not quite at a breakout, but close. This is also the most important and potentially dangerous time of a breakout. A higher Dollar should continue to lend support to Bitcoin in the current strong-Dollar policy environment.

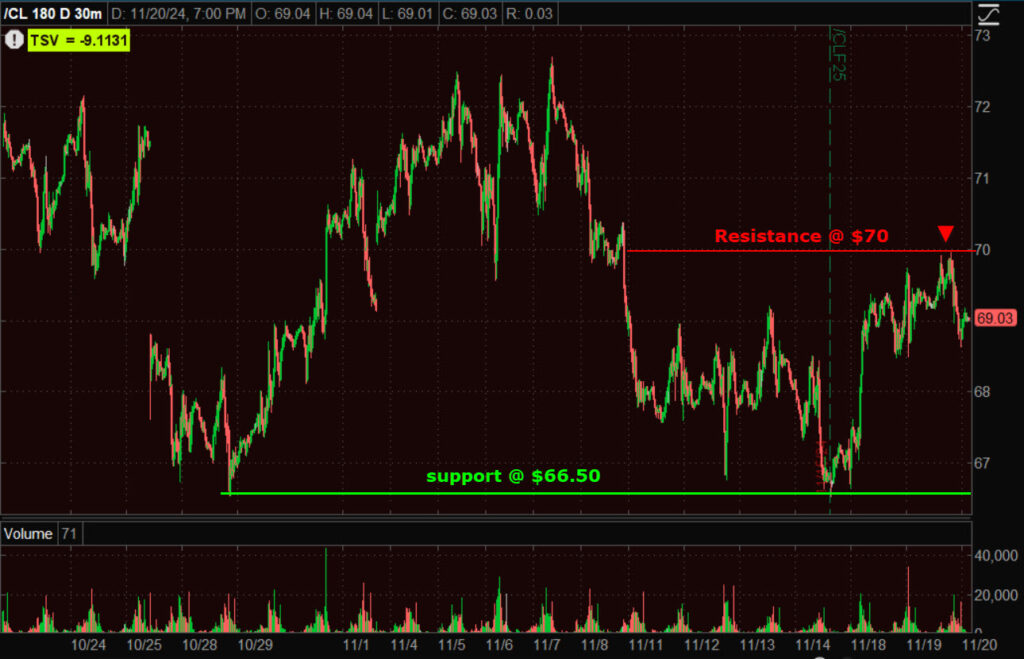

WTI Crude Oil closed lower by -0.3% to $69.04/bbl., which isn’t bad considering the stronger Dollar and the unfavorable oil inventories. The intraday high was $69.96, confirming the resistance area I expected at $70.

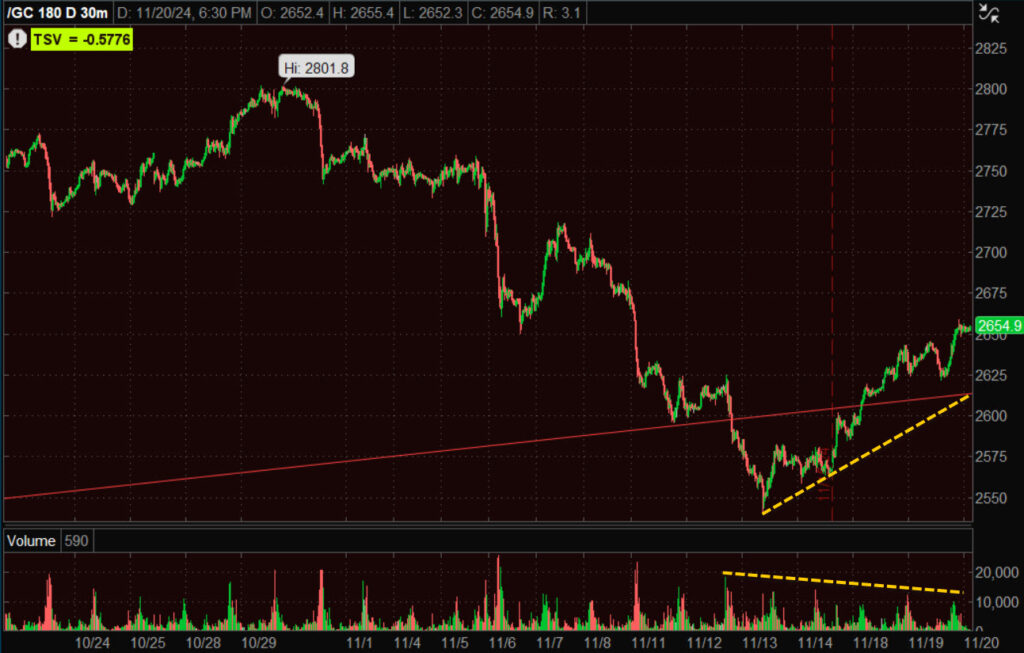

Gold futures settled higher by +0.8% to $2,651.70/oz, tapping one-week highs, in part due to escalating Russia-Ukraine tensions.

(30m) – Price still has not voided the possibility, if not probability of a bearish consolidation/correction (flag). Notice volume is falling as it should for a bear flag. The flag is a little steep, but I’m still not convinced Gold has found a near-term low. I’d rather be a little cautious and give price some more time, than worry about missing out on some potential profits. For short term traders, I’d place a stop either at the red trend line or $2600, which currently are the same. For longer term investors with long gold exposure, I would consider trimming some if price makes a new lower low (below $2556).

(30m) – Price still has not voided the possibility, if not probability of a bearish consolidation/correction (flag). Notice volume is falling as it should for a bear flag. The flag is a little steep, but I’m still not convinced Gold has found a near-term low. I’d rather be a little cautious and give price some more time, than worry about missing out on some potential profits. For short term traders, I’d place a stop either at the red trend line or $2600, which currently are the same. For longer term investors with long gold exposure, I would consider trimming some if price makes a new lower low (below $2556).

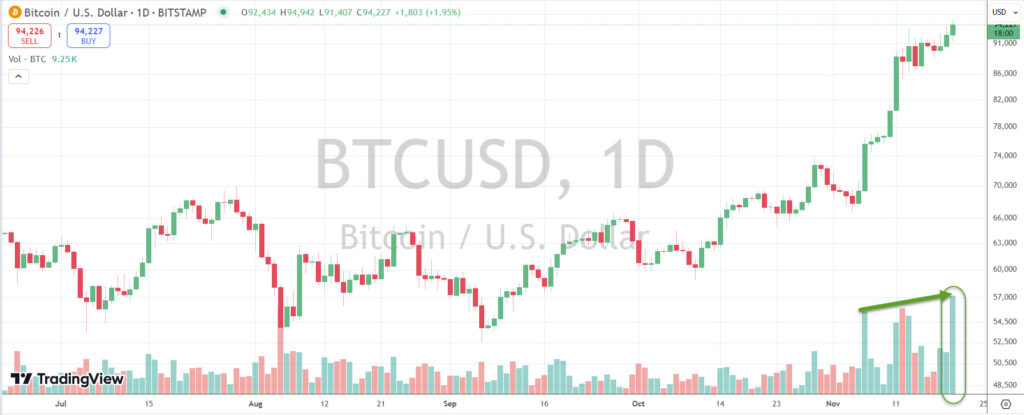

Bitcoin made another new all-time high today, falling just $28 shy of $95k. Volume looked much better today for what we should see for a breakout.

(daily) I think we can hit the upside measured move of $110k.

(daily) I think we can hit the upside measured move of $110k.

On that note, I wanted to follow-up on Coinbase (COIN -1.4%).

COIN (30m) – It looks like there’s a bullish Ascending Triangle forming. Volume looks good for the pattern, too.

COIN (30m) – It looks like there’s a bullish Ascending Triangle forming. Volume looks good for the pattern, too.

There is a big zone of long-term resistance in the area…

COIN (daily)

If price keeps tracking in the direction of a bullish Ascending Triangle and 3C confirms or starts leading higher, I think this could be a very interesting long trade. I would prefer to have the Ascending Triangle better formed, that way you can enter in the triangle and have a clear stop below the lower trend line.

Summary

I think we’re pretty up to date. Nvidia’s earnings beat, but missed the whisper number for guidance. NVDA is still down around -3% (-3.25%) in afterhours. I’d like to see what it looks like tomorrow as institutional money isn’t going to be too active in afterhours’ trade with much thinner liquidity, but thus far, it doesn’t look like Nvidia will re-spark large-cap Tech leadership, which brings us back to Trump trade cyclicals and value, which will have a hard time maintaining effective market leadership in the face of stronger de-leveraging in Growth/Momentum, Large & Mega Cap Tech.

Overnight

A “signifgant threat” shut down the U.S. embassy in Kyiv. I wonder what that threat is? Retribution and escalation? As both sides try to maximize and consolidate their territorial gains and negotiating leverage ahead of Trump’s inauguration, I fully expect we’ll see the kind of escalation we haven’t seen over the course of the war up to this week. Let’s hope it doesn’t include nukes. This could very well cause the pullback in the 10-yr yield to the trend line (safe-haven Treasury buying), and perhaps give gold a stronger edge for the same reason.

S&P futures are down -0.4%. Nasdaq-100 futures are down -0.55%.

VIX futures are consolidating bullishly into the overnight session.

The Dollar Index is own very modestly.

WTI Crude Oil futures are up +0.5%

Gold futures are up +0.3%

Bitcoin sits at $94,590.

Yields are a half basis point on either side of unchanged.

Thursday’s economic calendar features:

- Weekly Initial Claims at 8:30 ET (Prior 217K)

- Weekly Continuing Claims at 8:30 ET (Prior 1873K)

- November Philadelphia Fed Index at 8:30 ET (Prior 10.3)

- October Existing Home Sales at 10:00 ET (Prior 3.84 mln)

- October Leading Home Sales at 10:00 ET (Prior -0.5%)